Churn rate shows the percentage of customers who stop using a service, and it is measured over a certain time period. For SaaS businesses, understanding the saas average churn rate is crucial for tracking customer loyalty. This metric also indicates the overall health of the business. High churn rates can negatively impact growth by increasing Customer Acquisition Costs (CAC) and decreasing Customer Lifetime Value (LTV). When churn is high, income suffers, making it more challenging to achieve profitability.

Controlling churn is essential for long-term success. Studies indicate that reducing churn by just 5% can lead to a remarkable 95% increase in profits over five years. SaaS companies that maintain a low saas average churn rate enjoy steady income and enhanced growth. Keeping customers satisfied is vital for the business’s stability and fosters lasting relationships with users.

What is Churn Rate?

Definition of churn rate

Churn rate shows the percentage of customers who stop using a service. It is measured over a specific time period. For SaaS businesses, this number is important. It helps track how well a company keeps its customers. It also shows if the business meets customer needs.

Here’s how churn rate is explained in SaaS:

-

It measures how many customers leave, helping improve retention plans.

-

It is a key metric that shows user activity and service use.

-

It sets standards to check customer loyalty and subscription renewals.

In SaaS, churn rate is usually shown monthly or yearly. For example, a good monthly churn rate is 4% or less. Annual churn rates should stay under 5-7%. If churn rates are higher, companies may find it hard to grow or make profits.

Customer churn vs. revenue churn

Customer churn and revenue churn are two different ways to measure losses. Customer churn counts how many customers leave in a set time. Revenue churn looks at the money lost from those customers, including pricing levels.

These two metrics are important for SaaS businesses:

-

Customer churn: Counts how many customers cancel their subscriptions. It shows how happy and loyal customers are.

-

Revenue churn: Measures the money lost from cancellations. It highlights the need to keep high-paying customers.

Here’s a comparison of these metrics:

|

Metric |

Definition |

Importance |

|---|---|---|

|

Customer Churn |

Percentage of customers lost over a specific period. |

Helps check business health, especially for recurring revenue models. |

|

Revenue Churn |

Financial impact of lost customers, considering pricing tiers. |

Shows how churn affects profits, focusing on big-money losses. |

|

Retention Impact |

A 5% increase in retention can enhance profits by 25-95%. |

Shows how reducing churn improves profits and customer happiness. |

Knowing both metrics helps SaaS companies make better plans to reduce churn. For example, keeping high-paying customers can lower revenue churn, even if customer churn stays the same.

Why is Churn Rate Important for SaaS Businesses?

Impact on customer retention

Churn rate shows how well a SaaS business keeps customers. A high churn rate means customers are unhappy or not engaged. For SaaS companies, keeping customers is key to growing steadily. Studies show that lower churn rates lead to loyal customers and more renewals. For example, a 2019 report by KeyBanc Capital Markets found a median annual revenue churn of 13.2%. This shows why controlling churn is so important.

Customer churn affects how businesses plan to keep customers. Companies that improve customer experiences can lower churn. Fixing problems builds trust and long-term loyalty with users.

Effect on revenue and profitability

Churn rate directly affects money and profits. When customers leave, businesses lose income, making it hard to stay stable. Even small churn increases for subscription models hurt Monthly Recurring Revenue (MRR). Lower churn rates mean steady income and easier financial planning.

The table below shows how churn impacts key metrics:

|

Metric |

High Churn Impact |

Low Churn Impact |

|---|---|---|

|

Monthly Recurring Revenue (MRR) |

Unstable income |

Predictable income |

|

Annual Recurring Revenue (ARR) |

Long-term revenue drops |

Long-term revenue grows |

|

Profitability |

Lower profits from lost customers |

Higher profits from loyal customers |

|

Renewal Rates |

Fewer renewals |

More renewals |

Reducing churn helps SaaS businesses earn more and grow steadily.

Role in business sustainability

Managing churn is crucial for SaaS businesses to last long-term. High churn rates slow growth and hurt reputations, making it hard to get new customers. Low churn rates give businesses an advantage. A 2024 survey by KBCM Technology Group found longer contracts reduce churn since customers commit less often.

SaaS companies can stay strong by finding and fixing churn causes. Using data to spot unhappy users and acting on feedback helps. These steps keep income steady and build loyal customers, ensuring long-term success.

SaaS Average Churn Rate Benchmarks

Knowing churn rate benchmarks helps SaaS companies check their progress. These benchmarks change based on time, company size, and market type. Let’s look at the main numbers.

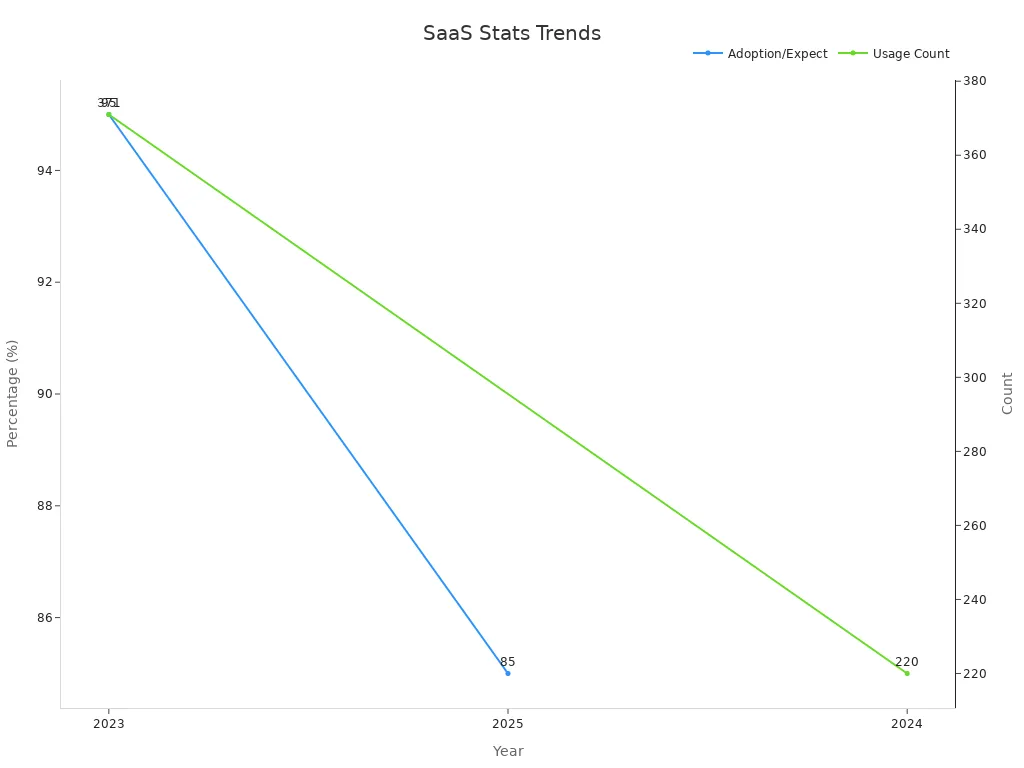

Monthly churn rate benchmarks

Monthly churn rates show how well a SaaS business keeps customers in short periods. Most SaaS companies have a monthly churn rate of 4%. Reports from Recurly (2025) and UserMotion (2024) show similar results, with rates of 4.1% and 4.2%.

Here’s a simple view of monthly churn rates:

|

Source |

Average Monthly Churn Rate |

Voluntary Churn |

Involuntary Churn |

|---|---|---|---|

|

Recurly (2025) |

4.1% |

3.0% |

1.1% |

|

UserMotion (2024) |

4.2% |

3.5% |

0.7% |

|

Churn Assassin |

3% – 7% (SMBs) |

N/A |

N/A |

Voluntary churn happens when customers choose to leave. It causes most losses. Involuntary churn happens due to payment issues and is smaller. To grow, businesses should aim for churn rates below 4%.

Annual churn rate benchmarks

Annual churn rates give a bigger picture of customer retention. A good annual churn rate for SaaS companies is between 5% and 7%. Across 1,200+ SaaS companies, the average annual churn rate is 4.1%. Voluntary churn is 3.0%, and involuntary churn is 1.1%.

Keeping a low annual churn rate helps keep income steady and builds strong customer ties. Companies with high churn rates may find it hard to grow. Watching both revenue churn and customer churn helps find areas to improve.

Differences by company size and market type

Churn rates vary by company size and market type. Small and medium businesses (SMBs) usually have churn rates between 3% and 7%. Bigger companies often have lower churn rates, sometimes as low as 1%.

Key reasons for these differences include:

-

Contract length: Bigger companies often have long-term deals, lowering churn.

-

Customer stability: Large companies attract stable clients, reducing cancellations.

-

Market maturity: Older SaaS companies aim for a 2% churn rate, showing their strong position.

Knowing these differences helps businesses set goals and adjust plans for their market.

How to Calculate SaaS Churn Rate

Knowing how to calculate churn rates is important for SaaS companies. It helps them improve customer retention and make more money. These calculations show how loyal customers are and the company’s financial health. Let’s look at the formulas and examples to make it simple.

Formula for customer churn rate

Customer churn rate shows the percentage of customers who leave in a set time. It tells how well a business keeps its users. The formula is easy:

Customer Churn Rate = (Customers Who Left / Total Customers at Start) x 100

For example, if a company starts with 1,000 customers and loses 50, the churn rate is:

(50 / 1,000) x 100 = 5%

Tracking this number over time helps spot trends. A high churn rate means the company needs to act fast to keep customers happy.

Formula for revenue churn rate

Revenue churn rate looks at the money lost from leaving customers. It includes revenue lost from cancellations or downgrades. The formula is:

Revenue Churn Rate = (Lost Revenue / Starting Revenue) x 100

For instance, if a company starts with $100,000 in revenue and loses $5,000, the revenue churn rate is:

($5,000 / $100,000) x 100 = 5%

This metric shows how much money the company loses. Keeping high-paying customers is key to reducing revenue churn.

Examples of churn rate calculations

Here’s an example for a SaaS company in one month:

-

Customers at the start: 2,000

-

Customers lost: 100

-

Starting revenue: $200,000

-

Revenue lost: $10,000

Using the formulas:

-

Customer Churn Rate: (100 / 2,000) x 100 = 5%

-

Revenue Churn Rate: ($10,000 / $200,000) x 100 = 5%

Both churn rates are 5%, showing the need for better retention plans. Improving onboarding or engaging customers more can help reduce churn.

Factors That Affect SaaS Churn

Pricing and Value for Money

Pricing affects how many customers stay or leave. People check if the service is worth the cost. If prices seem too high for the benefits, they may quit. Clear pricing plans and flexible options can solve this. Giving choices helps customers feel they pay for what they need.

Companies with higher earnings per customer often have lower churn. This shows pricing should focus on value. Businesses that offer great features or services keep customers longer. But unclear prices or high fees without extra perks push users away.

Keeping Customers Happy and Engaged

Happy customers stay longer with a SaaS product. Engaged users are more loyal and satisfied. Studies show fixing problems quickly can stop 67% of churn. Asking for feedback and helping early can solve issues fast.

When customers use a product often, it shows they like it. Watching how users interact can predict who might leave. For example, people who rarely use a product may think it’s useless. Talking to customers and building trust makes them stay longer.

Matching the Product to Customer Needs

A good product fit reduces churn. SaaS tools must solve real problems for users. People will leave if the product is hard to use or doesn’t meet needs. Checking how users behave can show what needs fixing.

When customers find value in a product, they stick around. High usage means the product fits their needs well. SaaS companies should improve their tools to match what customers want. This keeps users happy and builds a strong reputation.

Competition and market changes

Competition and market changes greatly affect churn rates for SaaS companies. Customers have many choices in crowded markets, making switching providers easy. This forces businesses to stand out and keep their users loyal.

Market changes, like price battles and shifting customer needs, add more challenges. For example, industries such as telecommunications and logistics face high churn rates of 31% and 40%. In contrast, computer software has a lower churn rate of 14% because of its subscription model and ability to serve both businesses and individuals.

|

Industry |

Churn Rate |

Main Factors Affecting Churn |

|---|---|---|

|

Computer Software |

14% |

Subscription plans, business vs. individual needs, service quality, price concerns |

|

Telecommunications |

31% |

Strong competition, price battles, service problems |

|

Logistics |

40% |

Delivery speed, accuracy, cost concerns |

|

Consumer Packaged Goods (CPG) |

40% |

Fast-changing trends, weak brand loyalty, price concerns |

Companies in tough markets must offer great value to succeed. Unique features, excellent support, and personalized services can lower churn. Also, tracking trends and customer habits helps businesses adjust and stay competitive.

Adapting to market changes means handling outside factors like economic shifts and new technology. SaaS companies that innovate and meet customer needs can reduce churn. This builds loyal customers and supports long-term growth.

Strategies to Reduce SaaS Churn

Make onboarding easy

Good onboarding helps customers stay longer. When users learn how to use a product quickly, they stay interested. SaaS companies can make onboarding simple with tutorials, checklists, and helpful tips inside the app. For example, Sked Social added a checklist and progress tracker during onboarding. This tripled the number of users who finished the process. Osano used a no-code tool to create pop-ups for onboarding. This made the process faster and cheaper, reducing churn.

The table below shows how onboarding helps reduce churn:

|

Case Study |

Company |

Problem Description |

Solution Description |

Result Description |

|---|---|---|---|---|

|

Onboarding Case #2 |

Osano |

Slow and costly way to make onboarding pop-ups. |

Used Userpilot’s no-code tool to create pop-ups easily. |

Lowered churn and improved user activity. |

|

Onboarding Case #4 |

Sked Social |

Few users finishing the onboarding process. |

Added a checklist and progress tracker to guide users. |

Got 3x more users to complete onboarding. |

Improve customer help and support

Quick customer help stops users from leaving. When users face problems, fast support can fix issues and keep them happy. SaaS companies should train teams to solve problems quickly. Regular check-ins and personalized advice also build trust and loyalty.

Metrics like Customer Retention Rate (CRR) and Net Revenue Retention (NRR) show how good support lowers churn. For example, higher CRR means users are happy and keep using the product. The table below explains key metrics that connect better support to lower churn:

|

Metric |

Description |

|---|---|

|

Customer Retention Rate (CRR) |

Shows the percentage of users who stay with the product. |

|

Churn Rate |

Measures the percentage of users who cancel subscriptions. |

|

Net Revenue Retention (NRR) |

Tracks revenue growth from current users, including upgrades and churn. |

|

Customer Lifetime Value (LTV) |

Predicts total money earned from a customer, with higher values showing better retention. |

|

Engagement Metrics |

Tracks how often users interact with the product, helping spot churn risks. |

Use data to stop churn

Data tools help SaaS companies find customers who might leave. Predictive models study user actions to guess who may cancel. Tools like Mixpanel and Baremetrics give useful insights by grouping users and tracking their habits. Mixpanel looks at lots of customer data to find trends. Baremetrics focuses on detailed churn analysis to spot behavior patterns.

The table below lists ways to use data for predicting churn:

|

Analytical Method |

Description |

|---|---|

|

Churn Prediction Model |

Groups customers into likely to leave or stay. |

|

Customer Churn Data Analysis |

Studies why customers leave based on data. |

|

Userpilot |

A no-code tool for grouping users, surveys, and tracking actions to predict churn. |

|

Mixpanel |

An analytics tool for studying large amounts of customer data to predict churn. |

|

Baremetrics |

Offers detailed analysis of churn groups to find behavior patterns. |

Using these tools helps SaaS companies act early to keep customers and lower churn rates.

Offer personalized solutions and incentives

Custom solutions help SaaS businesses keep their customers. When users see that a product fits their needs, they stay longer. Giving rewards like discounts, special features, or loyalty perks makes this connection stronger. These methods lower the churn rate and show customers they are valued. For instance, SaaS companies can study user habits to find problems or preferences. If a customer uses one feature often, they might like a guide or an upgrade to improve their experience.

Offering pricing plans with choices also helps. Customers can pick what fits their budget and needs, making them feel in control.

Rewards also help keep users. Discounts for yearly renewals or early access to new features encourage them to stay. These actions show customers they matter, reducing cancellations. Sending personalized emails about these offers can boost loyalty and keep users engaged.

Regularly gather and act on customer feedback

Customer feedback is key to fixing problems and keeping users. Asking for feedback often helps SaaS companies find what needs improvement. Listening to users and making changes builds trust and keeps them happy.

Here are ways to collect feedback effectively:

-

Ask for feedback during onboarding to fix early issues.

-

Keep gathering feedback to improve the product and meet user needs.

-

Use regular check-ins and data to spot problems early.

-

Show users you care by acting on their suggestions.

For example, if users say a feature is hard to use, the company can simplify it or add guides. This improves the experience and stops frustration. Over time, these efforts create loyal customers who feel valued.

Watching churn rate is key for SaaS companies to grow steadily. It shows how customers act and points out weak spots. Fixing churn with better support and custom solutions keeps users loyal. Retaining customers helps steady income and builds trust. Lower churn rates lead to steady growth and lasting success in tough markets.

FAQ

What is a good churn rate for SaaS businesses?

A good churn rate depends on the company and market. Usually, a monthly churn rate below 4% is healthy. For yearly rates, staying under 5-7% is ideal. Lower churn means customers are happy and the business is stable.

How can SaaS companies find customers likely to leave?

SaaS companies can use tools to study customer actions. Signs like using the product less, late payments, or bad reviews show risks. Predictive tools can group customers who might leave, helping businesses act early.

Why is revenue churn more important than customer churn?

Revenue churn shows how much money is lost from leaving customers. Losing high-paying users hurts income more than losing many low-paying ones. Keeping big spenders helps profits and growth.

How often should SaaS businesses check churn rates?

SaaS companies should check churn rates every month to spot changes. Monthly tracking helps fix problems fast. Yearly reviews give a bigger view of how the business is doing over time.

Can discounts help reduce churn?

Yes, discounts can make customers stay longer. For example, giving deals on yearly plans or rewards for loyalty works well. But discounts should match the product’s value to avoid making it seem cheap.